This blog aims to be a reliable and comprehensive source of information regarding withholding tax (WHT) in Saudi Arabia. We will help you to understand the fundamentals of KSA withholding tax, while also providing detailed information regarding tax rates, penalties, and compliance procedures among others. Analytix has years of experience providing expert tax advisory and company setup services in Saudi Arabia.

What is the Withholding Tax in Saudi Arabia?

The Saudi withholding tax is a type of income tax levied on non-residents who generate income from a Saudi source.

The person or establishment which makes the payment to the non-resident is known as the withholding person.

The Implementing Regulations of the Income Tax Law (ITL) states that withholding tax in Saudi Arabia will be charged on the total amount paid to the non-resident entity by the withholding person.

Who Pays Withholding Tax in Saudi Arabia?

Withholding tax in KSA is charged on payments made from a Saudi resident or private establishment in Saudi Arabia to a non-resident party for the rendering of services.

The tax is paid by the beneficiaries of the payment, which may include business entities and persons providing technical or management services and collects rent, interest, dividends, or royalties.

How Can Analytix Assist You With Withholding Tax in KSA?

Our experienced tax consultants can help you systematically process all paperwork and compliance procedures regarding the filing of withholding tax in Saudi.

Having an expert like Analytix by your side helps to make the entire process cost-effective and worry-free.

Types of Payments Subject to Withholding Tax

Withholding tax in Saudi applies to all non-resident entities whose source of income originates from Saudi Arabia. The KSA withholding tax needs to be paid regardless of whether the income comes from governmental or non-governmental enterprises.

The following types of payments in KSA are subject to withholding tax in KSA:

- Dividends

- Management or directors’ fees

- Services performed in whole or in part in Saudi Arabia

- Payment from business activities carried out in the KSA

- Rental income that includes:

- i) Lease of immovable property

- ii) Lease of moveable properties located in the KSA

- Income from debt claims falls within the WHT scope

- Licensing of industrial or intellectual properties in the KSA (royalty)

- Interest from Loans

- Insurance/reinsurance premiums

- Technical or consulting services, even when they are entirely performed abroad

What are the Withholding Tax Rates in Saudi Arabia?

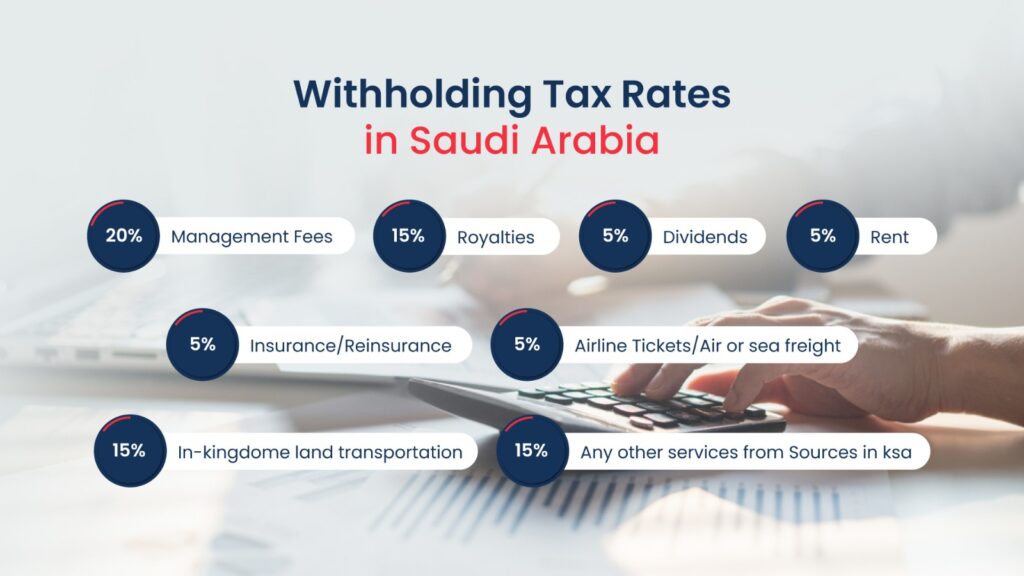

Unless the Withholding Tax in KSA is reduced by a tax treaty, the following rates apply for withholding tax in Saudi Arabia as stipulated under Article 63 of the Income Tax Law (ITL):

What are the Withholding Tax Obligations You Should Keep in Mind?

Saudi Arabia has to mandatorily file their withholding tax returns every month.

It is necessary to pay your withholding tax before the deadline to avoid penalties. Analytix can help you with WHT filing, as well as provide strategic advice and support.

When Are The Withholding Tax Deadlines?

The withholding tax in Saudi Arabia needs to be paid by the withholding person during the first ten days of the month through the Zakat, Tax and Customs Authority (ZATCA) portal.

Suppose a transaction is made during a given month that qualifies for WHT, the tax needs to be filed during the first 10 days of the following month.

At the same time, an annual withholding tax return needs to be filed 120 days from the end of the year. The same for partnerships is 60 days from the year’s end.

What Exemptions and Reductions are Available for Withholding Tax?

Exemption from withholding tax in Saudi Arabia is possible in the case of the following two scenarios:

- The non-resident’s business activity is exempted from withholding tax in Saudi Arabia.

- There is a tax treaty between Saudi Arabia and the non-resident’s country of origin which provides exemptions or special rates for withholding tax.

For convenient processing of exemptions and tax reductions, please keep your payment documents and contract in hand. This will ensure that you will not be charged by Saudi authorities for non-payment of tax.

Is Your Business Activity in Saudi Eligible for Exemption From Withholding Tax?

Saudi Arabia exempts all income generated by non-residents for supplying construction materials to KSA from the scope of withholding tax.

This is done to promote infrastructure development in Saudi. It is the only activity that is exempted from withholding tax (WHT) in Saudi Arabia.

How Do Tax Treaties Affect Your Withholding Tax Obligations?

The Kingdom of Saudi Arabia has formed tax treaties with various countries across the world for efficient and cost-effective trade between nations. The goal is to promote the business activities of non-residents in Saudi Arabia and improve the local economy.

If your country has tax treaties with Saudi Arabia, it might provide special rates or exemptions from withholding tax in KSA. Check if your country has a tax treaty with Saudi Arabia. It may help you gain a withholding tax exemption.

What are the Consequences of Non-Compliance With Withholding Tax Rules?

It is not advisable to practice non-compliance with any type of tax return in Saudi Arabia.

Not filing your withholding tax returns on time will lead to late fines and penalties, and will prove costly and burdensome for your business.

The Saudi Zakat, Tax and Customs Authority (ZATCA) can also charge you with tax evasion which will lead to higher penalties.

Withholding Tax Penalties In Saudi Arabia

Non-payment of withholding tax in Saudi within the stipulated time leads to penalties.

A penalty of 1% of tax value is charged for every 30 days delay from the due date.

If the Saudi Zakat, Tax and Customs Authority (ZATCA) suspects that you are evading taxes, an additional fine of 25% will also need to be paid.

How is Remittance and Reporting Done for Withholding Tax (WHT) in Saudi?

We will discuss here how you can pay and report withholding tax in Saudi Arabia.

Reporting: It is possible to report your withholding tax (WHT) in Saudi Arabia online. You can visit the Saudi Zakat, Tax and Customs Authority (ZATCA) online portal and declare your tax through your registered account.

Remittance: The tax amount can be paid online through the ZATCA portal.

What Does the Tax Treaty Between the UAE and Saudi Cover?

Saudi Arabia has signed a Double Tax Treaty (DTT) with the UAE which became effective from 1 January 2020. We have outlined below the significant features of the treaty:

- Withholding tax is exempted from service fees as long as the services are not for establishing a permanent establishment (PE) in Saudi.

- WHT is exempted from interest payments.

- WHT on royalty payments is reduced to 10%.

- WHT on dividends is 5%

WHT exemption on UAE Sovereign Wealth Funds and capital gains made from the sale of shares in KSA.

Need Help In KSA Withholding Tax?

Analytix can offer you strategic guidance to manage your Withholding Tax in Saudi Arabia. We can help you with the registration process on ZATCA, as well as filing tax returns and managing tax liability.

- FAQs

Frequently Asked Questions

If your question is not addressed here, please feel free to reach out to us. We value your inquiry.

How much is the withholding tax in Saudi Arabia?

The withholding tax in Saudi Arabia ranges from 5% – 20% depending on the type of service that is being taxed.

Is there a 15% withholding tax in Saudi Arabia?

There is a 15% withholding tax in Saudi Arabia for royalties. But the rate differs for other types of services. Contact us for detailed information.

How do I claim withholding tax in Saudi Arabia?

Filing of withholding tax in Saudi Arabia can be done through the ZATCA website. You can also take the help of a tax expert such as Analytix for streamlined tax filing.

What is the WHT guideline for Saudi Arabia?

In Saudi Arabia, the withholding tax (WHT) needs to be paid through the ZATCA portal monthly.

What are the double tax treaties with Saudi Arabia?

Saudi Arabia has double tax treaties with various countries across the world. These treaties provide citizens of these countries with specific tax rates and advantages when doing business with Saudi Arabia.